EC Sales list – Getting it right!

What is an EC Sales List?

Any VAT registered business in the United Kingdom which supplies goods or services to VAT registered customers in another country within the European Union (EU), must report these supplies to HM Revenue and Customs.

An EC Sales List includes three separate pieces of information:-

- The customer’s country code

- Details of the EU Customer

- The sterling value of the supplies made

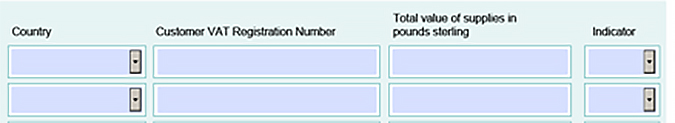

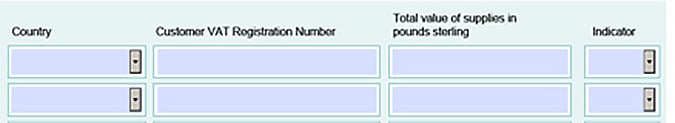

During the specified reporting period (i.e. monthly, quarterly, annually) a line for each customer, for each type of supply, will need to be entered for all the VAT registered EU businesses that you have entered into transactions with. The details that you will need to enter will be already be set up in an easy to use format using H M Revenue and Customers online service:-

- Two letter country code – for example, France will be FR

- The customer’s VAT registration number

- The value of the goods and services will need to be entered in sterling and not the foreign currency amount. Furthermore, these are to the nearest pound so no need to worry about pence!

- Finally, there is an indicator column where you need to let HMRC know whether you have supplied goods or services. Enter a ‘0’ in the indicator column for goods or a ‘3’ for services. You could also potentially have to enter a ‘2’ where triangulation has taken place. This is where you have supplied goods but they were not handled by yourself and one of your suppliers has directly sent them to your customer.

All the bullet points above are summarised in this easy to follow table when submitting an EC Sales List:-

Checking VAT numbers

Before you go to the HMRC website to submit an EC Sales List, you must ensure that all your information is accurate. As a result, it is crucial that the EU VAT numbers that your customers supply you with are correct. It is surprising how often the incorrect information is supplied, so it’s vital that you know these numbers are valid and you have confirmation that these customers are based in the EU.

It is extremely important that these EU VAT numbers are checked thoroughly. A popular website used for this exercise is http://ec.europa.eu/taxation_customs/vies/ and will make sure that all this information can be verified in a quick and efficient manner!

This will apply for every new customer.

Need help?

EC Sales Lists can be straightforward provided you know what you’re doing and you anticipate it coming. Should you need any help, please do not hesitate to contact us.

Kelly Southby

Kelly.Southby@Arnoldhill.co.uk

]

Emma Curness

Emma.Curness@Arnoldhill.co.uk

The information in this article is believed to be factually correct at the time of writing and publication, but is not intended to constitute advice. No liability is accepted for any loss howsoever arising as a result of the contents of this article. Specific advice should be sought before entering into, or refraining from entering into any transaction.