Extension to the Coronavirus Job Retention Scheme (CJRS) to 30th September 2021

21 April 2021

Extension to the Coronavirus Job Retention Scheme (CJRS) to 30th September 2021

The Coronavirus Job Retention Scheme (CJRS), also known as the furlough scheme, had officially been due to close at the end of April, however it has been announced that the CJRS will remain open for a further five months to 30 September 2021.

Key Highlights:

- The categories of employees and others in respect of whom claims can be made under the CJRS will remain unchanged.

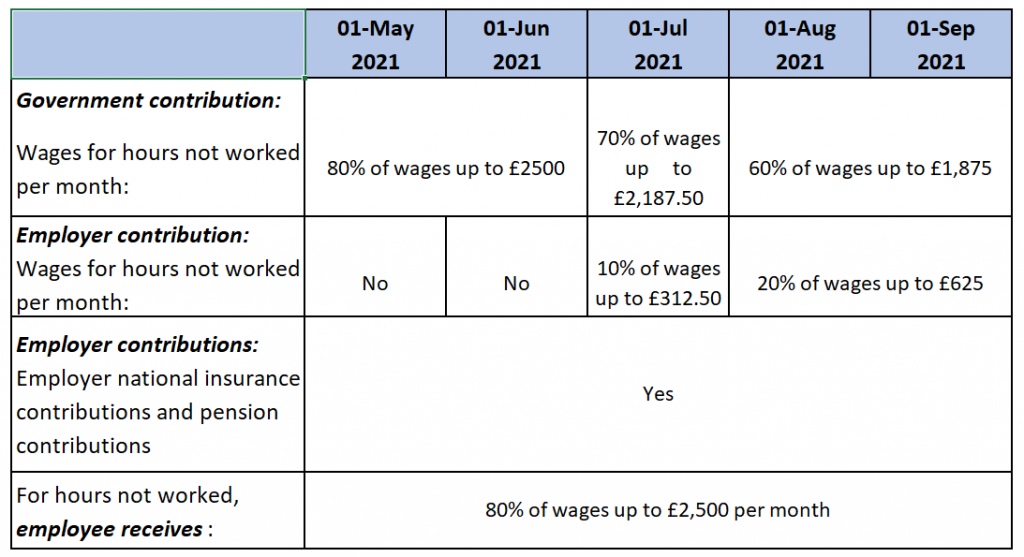

- Up until 30 June 2021 the Government will continue to pay 80% of wages for hours not worked, up to the cap of £2,500 per month.

- From 1 July 2021, employers will be asked to contribute towards the cost of furloughed workers’ wages.

- From 1 July 2021 the Government will pay 70% of wages, with employers expected to pay the remaining 10%. The overall capped amount remains at £2,500 per month.

- From 1 August until 30 September 2021 the Government will pay 60% of wages and employers are required to pay 20%. The overall capped amount remains at £2,500 per month.

- Employers will continue to pay employer’s national insurance and pension contributions in respect of their workers’ furlough pay as they do under the current terms of the CJRS.

- It will still be a requirement of the CJRS that workers in respect of whom claims are made must not work or provide any services in relation to their employment during the hours for which they are furloughed.

- Employers may continue to choose to top up their employees’ wages to 100% for the hours not worked at their own expense, but they do not have to.

The information in this article is believed to be factually correct at the time of writing and publication, but is not intended to constitute advice. No liability is accepted for any loss howsoever arising as a result of the contents of this article. Specific advice should be sought before entering into, or refraining from entering into any transaction.

Written by

Ruby Dutt

View Profile